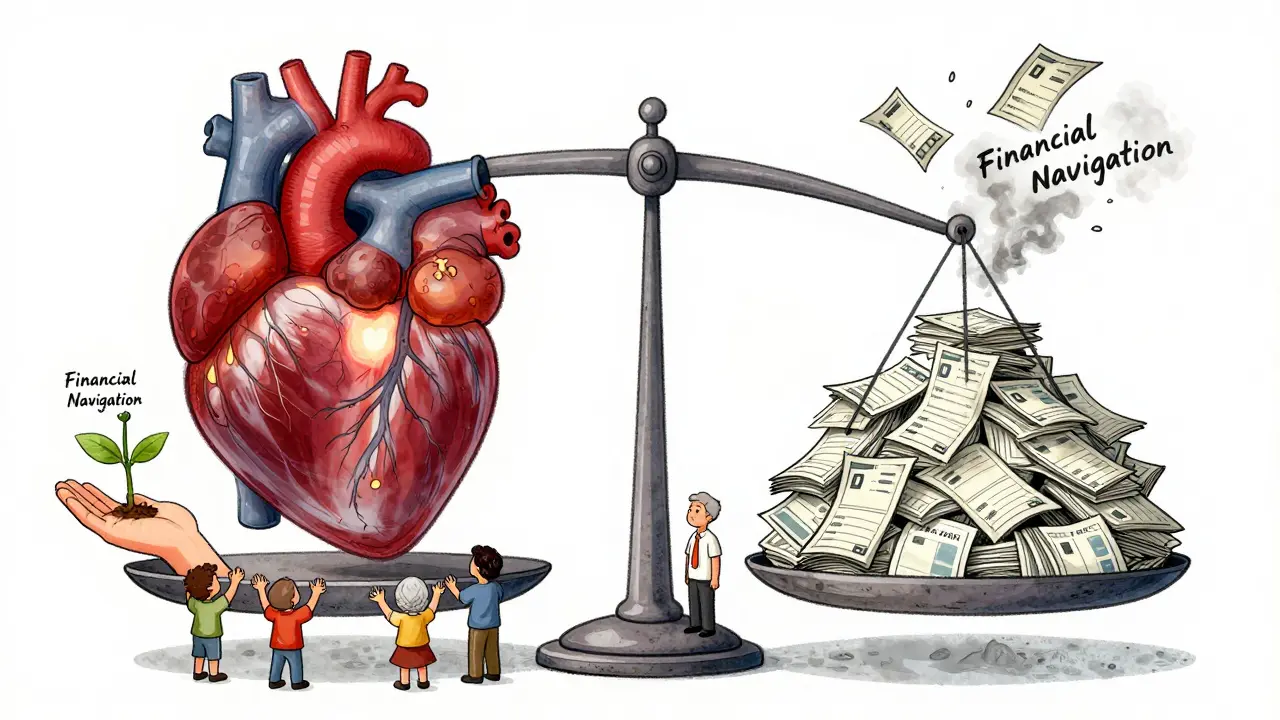

What Financial Toxicity Really Means for Cancer Patients

Financial toxicity isn’t a buzzword. It’s the moment a cancer patient has to choose between buying their next round of chemotherapy and paying the rent. It’s the parent skipping meals so their child can get their targeted therapy. It’s the 58-year-old who lost their job and now watches their insurance deductible climb higher than their savings account.

The term was first used by researchers at Duke University in 2013, but it wasn’t until 2023 that the National Cancer Institute officially defined it as "problems a patient has related to the cost of medical care." That’s not just about bills. It’s the anxiety, the shame, the sleepless nights wondering if you’ll have to stop treatment because you can’t afford it.

Here’s the hard truth: between 28% and 48% of cancer survivors face measurable financial hardship because of treatment. And when you ask people how they feel - not just what they owe - that number jumps to 73%. This isn’t rare. It’s routine.

Why Cancer Treatment Costs Are So High - and Getting Worse

Cancer care is no longer just about chemo and surgery. Today’s treatments include immunotherapies that cost $150,000 a year, oral targeted drugs that need to be taken daily for years, and clinical trials that sound promising but come with hidden expenses like travel, lodging, and lost wages.

Take immunotherapy: a single course of Keytruda or Opdivo can run over $100,000. And unlike traditional chemo, which often ends after six months, these drugs can be given indefinitely. Patients aren’t just paying for treatment - they’re paying for a lifestyle change that lasts years.

Insurance hasn’t kept up. Deductibles have doubled in the last decade. Coinsurance rates are higher. Many plans now have separate, high-cost tiers for specialty drugs - meaning even with insurance, patients pay 30%, 40%, or more out of pocket. A 2021 study found that 13% of non-elderly cancer patients spend at least 20% of their entire annual income just on out-of-pocket cancer costs. For low-income women with breast cancer, that number hits 98%.

Who Gets Hit the Hardest - And Why

Financial toxicity doesn’t affect everyone equally. Three groups are hit hardest:

- Younger patients (under 65): They’re more likely to be working, raising kids, and paying off student loans. They have less saved up and often have high-deductible plans that leave them exposed.

- Patients with metastatic cancer: Their treatment doesn’t end after a year. It goes on for years - sometimes for life. Each year adds tens of thousands in costs.

- Low-income and uninsured patients: Even with Medicaid or subsidized insurance, copays for oral drugs can be unaffordable. Many skip doses or delay refills because they can’t afford the $50 co-pay on a $1,200 pill.

One study of patients in phase 1 clinical trials - the most cutting-edge, expensive treatments - found that 82% were worried about medical costs and 79% felt financial stress. These aren’t people without options. These are people who chose hope… and then got hit with a bill they couldn’t pay.

How Financial Toxicity Hurts Your Health

It’s not just about money. It’s about survival.

Patients who report financial distress are more likely to:

- Skip or cut back on medication

- Delay or refuse scans and follow-ups

- Report worse pain, more depression, and lower quality of life

- Feel more anxiety about cancer coming back

One patient told researchers: "I’d rather die than go bankrupt." That’s not an exaggeration. Studies show financial toxicity is linked to higher death rates - not because the cancer is more aggressive, but because patients stop taking the drugs that keep it in check.

The National Cancer Institute found that for many, financial toxicity felt more severe than physical side effects, emotional distress, or family strain. That’s not just a statistic. That’s a crisis.

What’s Being Done - And What’s Working

Some hospitals are finally waking up. Financial navigation programs - where trained staff help patients find aid, apply for grants, and negotiate bills - have cut treatment abandonment by 30% to 50% in places that use them.

Organizations like the Patient Advocate Foundation gave $327 million in co-pay assistance to 67,000 cancer patients in 2022 alone. Drug manufacturers provided $12.8 billion in patient support programs the same year. But here’s the catch: many patients don’t know these programs exist. Or they’re too sick to apply. Or the paperwork is too complex.

Tools like the Comprehensive Score for Financial Toxicity (COST) are now being used in clinics to screen patients. It’s a simple five-question survey that asks things like: "Have you cut back on food or heat to pay for treatment?" Clinics using it found they identified 45% more at-risk patients than before.

California passed a law in 2022 requiring drugmakers to justify price hikes for cancer drugs. Other states are watching. The Cancer Drug Parity Act, reintroduced in 2023, would force insurers to charge the same copay for oral drugs as they do for IV chemo - a huge win, since oral drugs are often more expensive and less covered.

What You Can Do Right Now

If you or someone you love is facing cancer treatment, here’s what actually helps:

- Ask for financial help early. Don’t wait until the bill arrives. Talk to your oncology nurse or social worker. Ask: "Is there a financial navigator here?"

- Know your insurance. Call your insurer. Ask: "What’s my out-of-pocket max for cancer drugs this year? Is there a tiered formulary? Are there generic or biosimilar options?"

- Check patient assistance programs. Go to NeedyMeds.org or the Patient Advocate Foundation website. Search by drug name. Many programs have no income limit - just a diagnosis.

- Ask about clinical trials. They’re not just for last-resort cases. Many trials cover all treatment costs, including travel. Ask your doctor: "Is there a trial that might reduce my costs?"

- Don’t be afraid to negotiate. Hospitals often have charity care programs. Call billing and say: "I can’t afford this. What can you do?" Many will reduce bills by 50% or set up payment plans with 0% interest.

The Bigger Picture - And Why This Must Change

Financial toxicity isn’t just a patient problem. It’s a system failure. We’ve built a healthcare model where innovation is rewarded with sky-high prices, and patients pay the price.

Dr. Scott Ramsey from the Hutchinson Institute says financial toxicity should be treated like nausea or fatigue - a standard side effect that every oncologist screens for. By 2025, he predicts 75% of NCI-designated cancer centers will have formal screening in place. That’s progress. But it’s not enough.

Real change means:

- Putting caps on out-of-pocket drug costs

- Requiring insurers to cover all FDA-approved cancer drugs without prior authorization

- Making financial counseling a required part of cancer care - not an optional add-on

Until then, patients are left to navigate a maze of aid programs, confusing bills, and guilt. No one should have to choose between living and going broke.

It’s Not Just About Money - It’s About Dignity

Financial toxicity isn’t just a number on a bill. It’s the mother who cries because she can’t afford her daughter’s wig. It’s the man who works two jobs while on chemo. It’s the teenager who hides their pills because they’re too embarrassed to ask for help.

When we talk about cancer care, we talk about survival. But we can’t talk about survival without talking about cost. Because if you can’t afford the treatment, you don’t survive.

Daz Leonheart

February 4, 2026 AT 06:30Coy Huffman

February 6, 2026 AT 03:55Amit Jain

February 7, 2026 AT 09:15Keith Harris

February 9, 2026 AT 06:58Kunal Kaushik

February 10, 2026 AT 21:04Mandy Vodak-Marotta

February 11, 2026 AT 13:46Nathan King

February 11, 2026 AT 21:02Harriot Rockey

February 13, 2026 AT 09:17